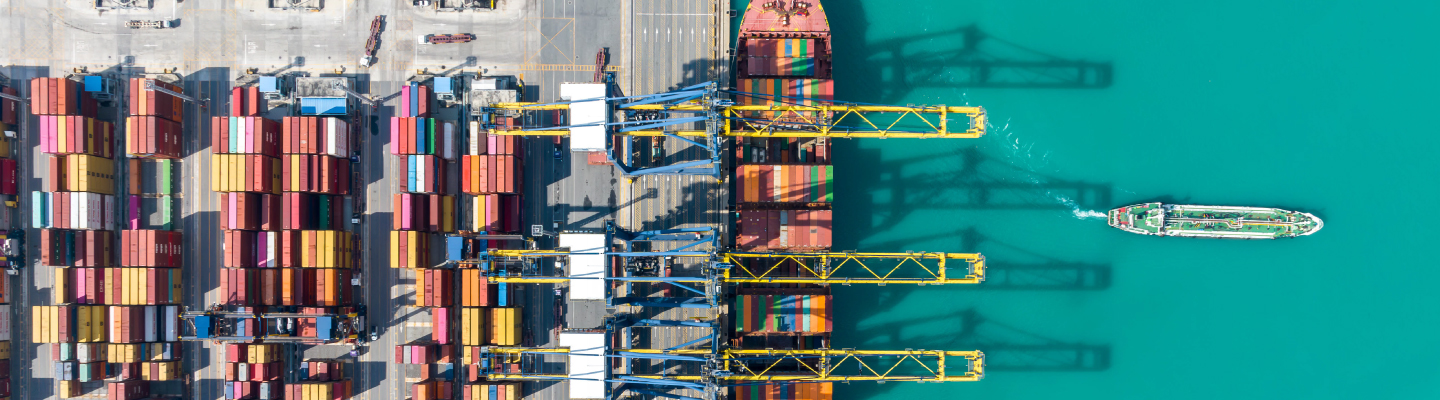

As global business and trade dynamics evolve, including the impact of U.S. President Trump's proposed tax and tariff policies, understanding the implications of these changes and broader shifts in trade policy is crucial for businesses.

You are invited to join a one-and-half-hour presentation, led by the BDO Singapore Global Value Chain leaders where we will further discuss key tax, transfer pricing, customs, and supply chain considerations of the global tax and trade environment and share important insights on how leading companies are responding, and innovative strategies to mitigate the impact of these changes on business operations and financial performance.

Key topics to be covered:

- Scenarios for an increased tariff environment and supply chain considerations to manage/mitigate impact

- Potential changes to U.S. tax rules that could impact companies doing business in the U.S. and planning steps to consider in preparation for change

- Update and insights on broader supply chain and operation model trends and best practices

Date: February 20, 2025

Time: 3:30 pm to 5:00 pm

Fee: Complimentary

Venue: BDO Singapore, Nanyang Room, 600 North Bridge Road, #17-01, Parkview Square. Singapore 188778

Note: Registration is on a first-come-first-served basis, and you will be informed via email (nearer the event date) when your registration is confirmed.

By submitting your details, you agree to us processing your data in accordance with our Data Protection Policy.

The organiser reserves the right to change the date, time and programme due to circumstances outside our control. You will receive the confirmation note via email (nearer the date) when your registration is confirmed.